By: Sukhdeep Singh Sembi

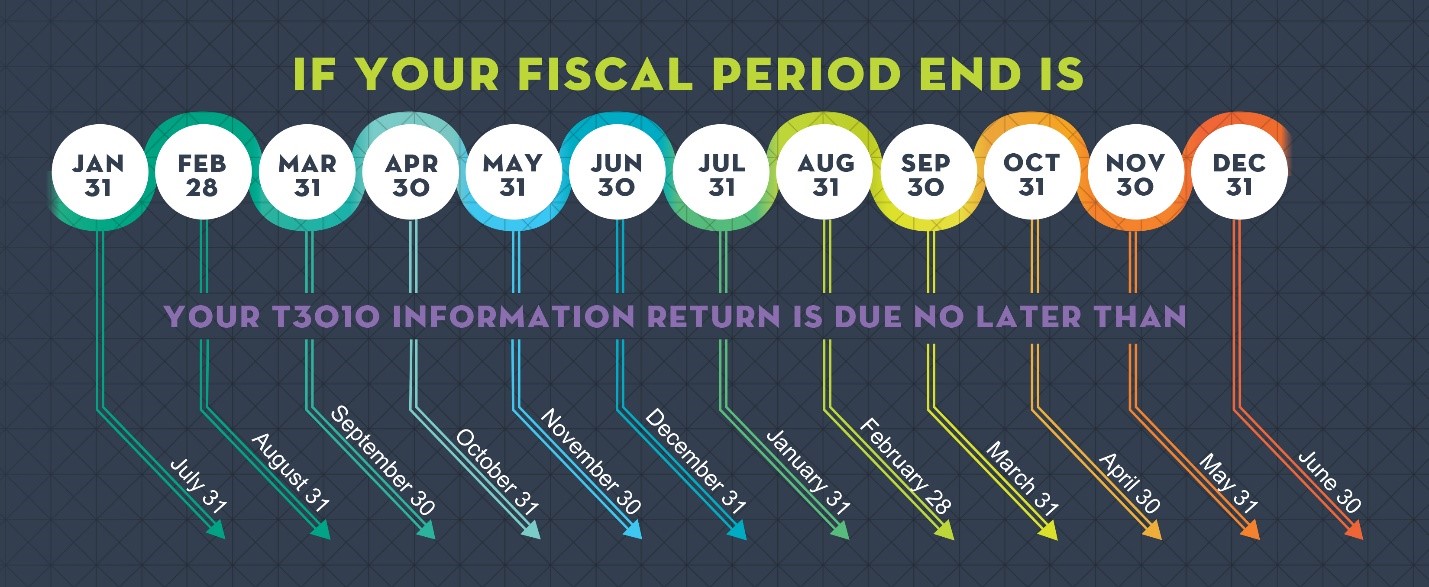

The continued effort to simplify correspondence to taxpayers from the CRA has recently resulted in the agency publishing an infograph to help charities understand when their annual filings are due.

Charities must file the T3010 information return within six months of its fiscal year-end. The process is slightly more complicated when the charity’s fiscal year-end changes. In these cases there are different submission deadlines which may pass by if the charity is unaware . Failing to submit the T3010 filing requirements could result in the loss of charitable status for the charity . In 2015 just over 700 organizations lost their charitable status for failing to file their annual return.

Improving compliance by charities is a win-win for the CRA, which will help to alleviate the strain of reminding and chasing charities for their annual filing information. In 2015 nearly half of the revocations handed to charities were a result of failing to file annual returns.

The infograph is part of a wider plan to redesign all of the CRA correspondence, for individuals and businesses, within the next three years. This year alone has seen the rollout of two projects, the simplified Benefits Notices to benefit recipients, as well as the simplified Notice of Assessment.

In collaboration with the simplified correspondence, the CRA along with the Department of Finance and other stakeholder groups, will publish and promote more online tools to help clarify the rules surrounding charities.